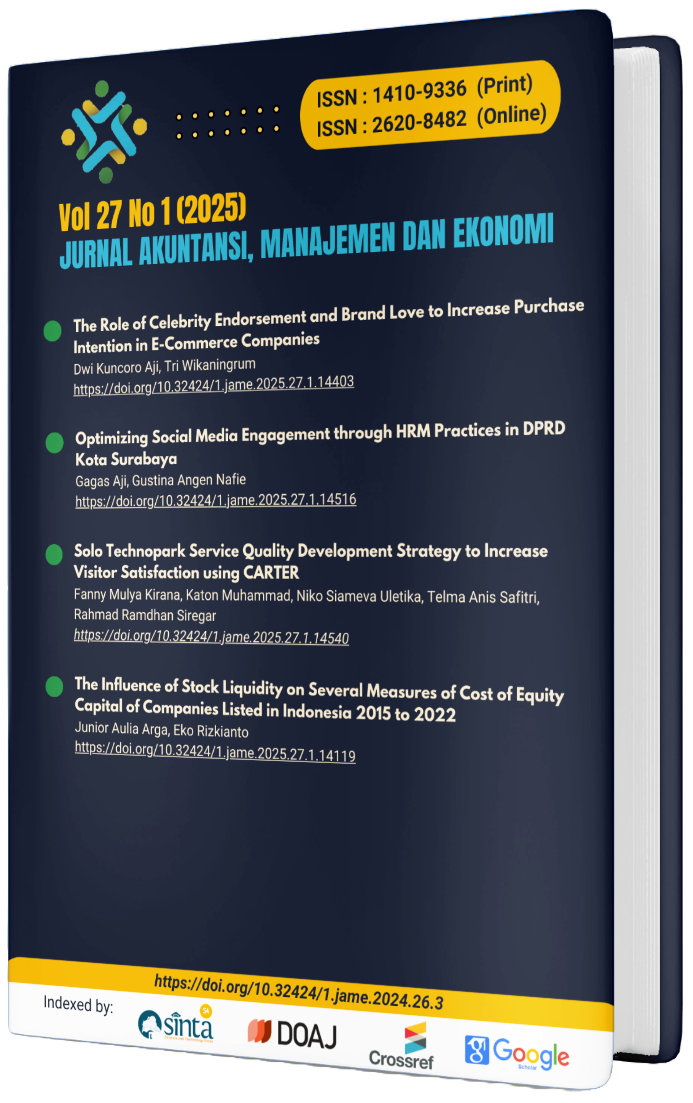

The Influence of Stock Liquidity on Several Measures of Cost of Equity Capital of Companies Listed in Indonesia 2015 to 2022

Abstract

Research on the influence of stock liquidity on equity capital cost is still scarce in the context of developing countries. Furthermore, there are differences in the cost of equity proxies in the literature. This study aims to investigate the influence of stock liquidity on companies’ cost of equity capital in Indonesia from 2015 to 2022. Through a series of tests conducted, empirical evidence is found that stock liquidity has a significant influence on cost of equity capital estimated by Price-Earning to Growth Model and model by Ohlson & Juettner-Nauroth. As hypothesized, the lower the liquidity of a stock (the higher the value of stock illiquidity Amihud or its bid-ask spread), the higher the cost of equity capital faced by the company, and vice versa. On the other hand, the cost of equity capital estimated with the Capital Asset Pricing Model shows an illiquidity discount for less liquid shares.